# Load the packages

library(reshape2)

library(ggplot2)

library(ggh4x)

library(ggcorrplot)

library(car) # to calculate the VIF values

library(GGally) # for pairs plot using ggplot framework

library(cmdstanr)

library(bayesplot)

library(rstanarm)

library(tidyr)Good houses are always in demand. However in the recent times, the price of house has increased exponentially. It will be interesting to identify the factors affecting the price of house. I found this dataset on UCI machine learning repository which gives the house price per unit area and related variables.

The idea is to build a predictive model to predict house price per unit area based on the variables like the age of house, etc. We will look at the exploratory data analysis first and later build prediction models. First let us access and process the data through R.

# Get data from github repo

path = "https://raw.githubusercontent.com/adityaranade/portfolio/refs/heads/main/real_estate/real_estate_valuation.csv"

data0 <- read.csv(path, header = TRUE)

# Data processing

# clean the column names

colnames(data0) <- c("ID", "date", "house_age", "distance", "number_store", "latitude", "longitude", "price")

# Check the first 6 rows of the dataset

data0 |> head() ID date house_age distance number_store latitude longitude price

1 1 2012.917 32.0 84.87882 10 24.98298 121.5402 37.9

2 2 2012.917 19.5 306.59470 9 24.98034 121.5395 42.2

3 3 2013.583 13.3 561.98450 5 24.98746 121.5439 47.3

4 4 2013.500 13.3 561.98450 5 24.98746 121.5439 54.8

5 5 2012.833 5.0 390.56840 5 24.97937 121.5425 43.1

6 6 2012.667 7.1 2175.03000 3 24.96305 121.5125 32.1We will focus on the 3 variables as follows

house_age : age of house in years.

distance : distance to nearest MRT station in meters.

number_store : the number of convenience stores in the living circle on foot.

price : Price per unit area where 1 unit is 1 ping = 3.3 sq. meter

Let us look at the distribution of these 3 variables

# Check the rows which do not have any entries

ind.na <- sum(is.na(data0))

ind.na # No NA values[1] 0# Filter the data

# column house_age, distance and price

# data <- data0 |> select(c(house_age,distance,price))

data <- data0[,c("house_age","distance","number_store","price")]

data |> head() house_age distance number_store price

1 32.0 84.87882 10 37.9

2 19.5 306.59470 9 42.2

3 13.3 561.98450 5 47.3

4 13.3 561.98450 5 54.8

5 5.0 390.56840 5 43.1

6 7.1 2175.03000 3 32.1# Data for histogram

melted_data <- melt(data)

# Plot the histogram of all the variables

ggplot(melted_data,aes(value))+

geom_histogram(bins = 20)+

# geom_histogram(aes(y = after_stat(density)),bins = 20)+

facet_grid2(~variable, scales="free")+theme_bw()

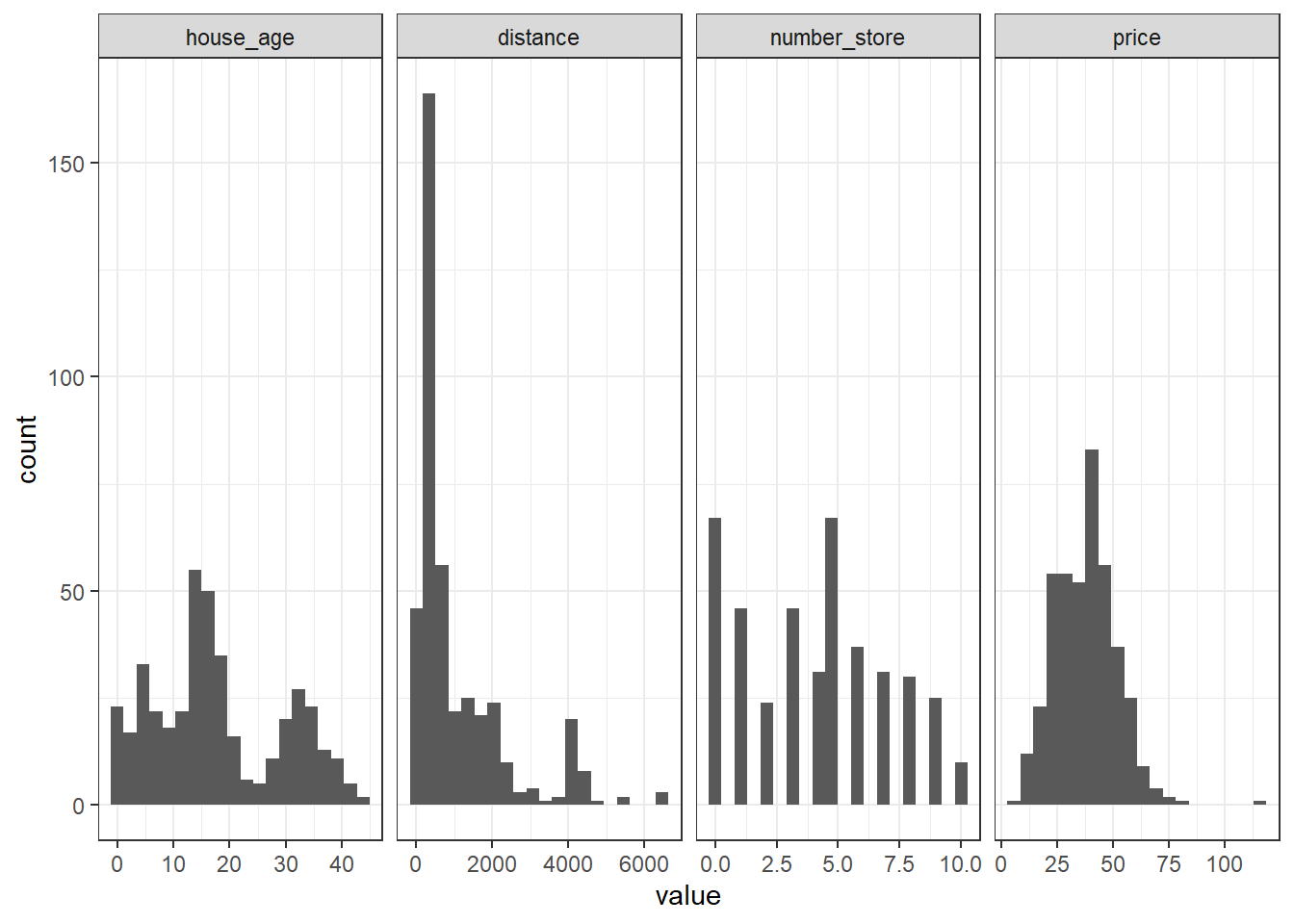

Histogram does not give much information. Let us look at the correlation plot to get an idea of how the variables are correlated with each other.

# correlation plot of all the variables

corr <- round(cor(data), 2)

ggcorrplot(corr)

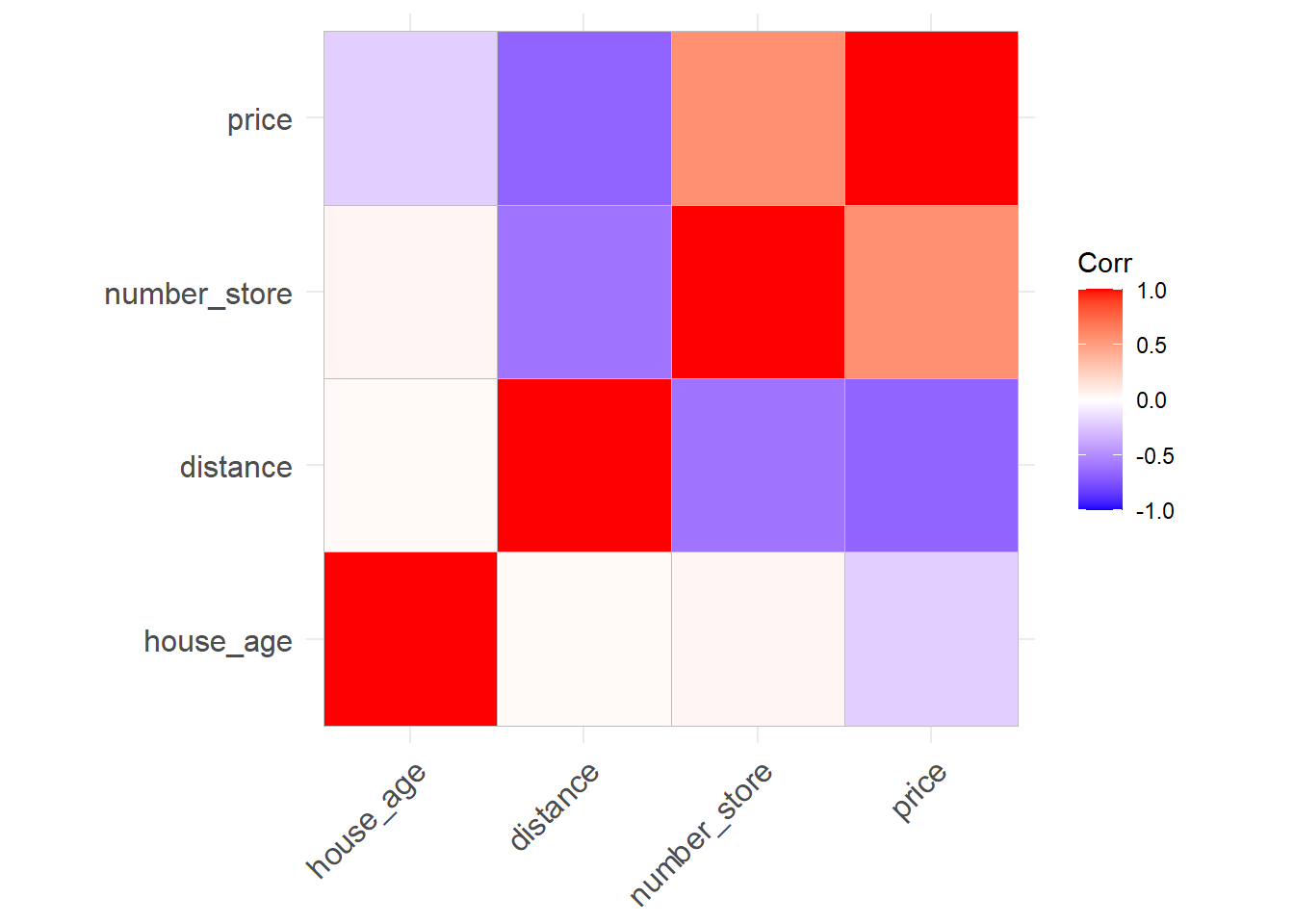

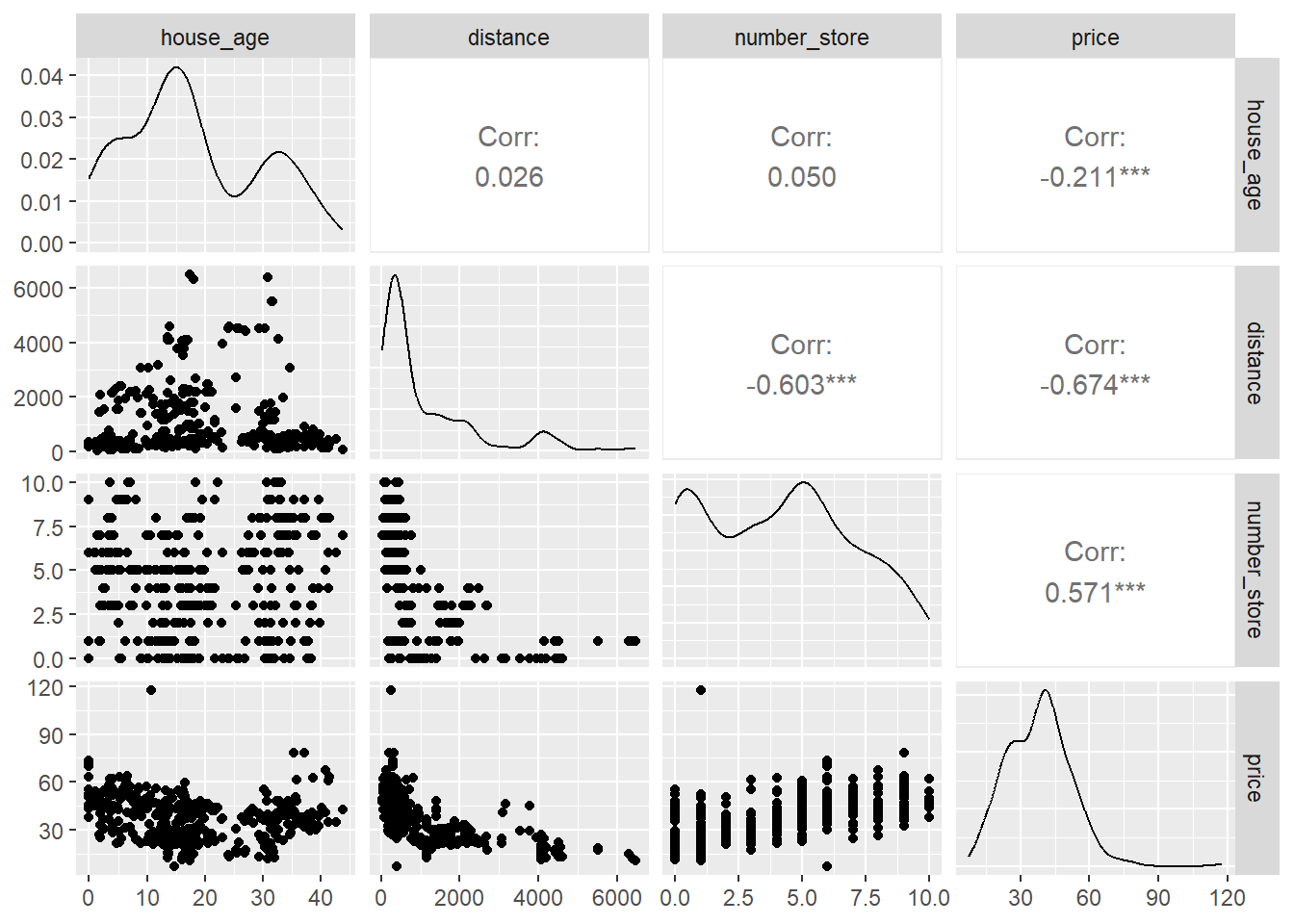

house_age is not related to distance and number_store which is not surprising. distance variable is positively correlated with number of stores which again not surprising. However price is negatively correlated with distance to nearest MRT station as well as house age and positively correlated with number of stores in the vicinity which is again logical. Next we look at the pairs plot which will show the bivariate scatter plots as well as the correlation between each variables. Scatter plots in the last row is of interest as it shows the pairwise scatterplots where price is on the y axis and the other variables are on the x axis.

ggpairs(data)

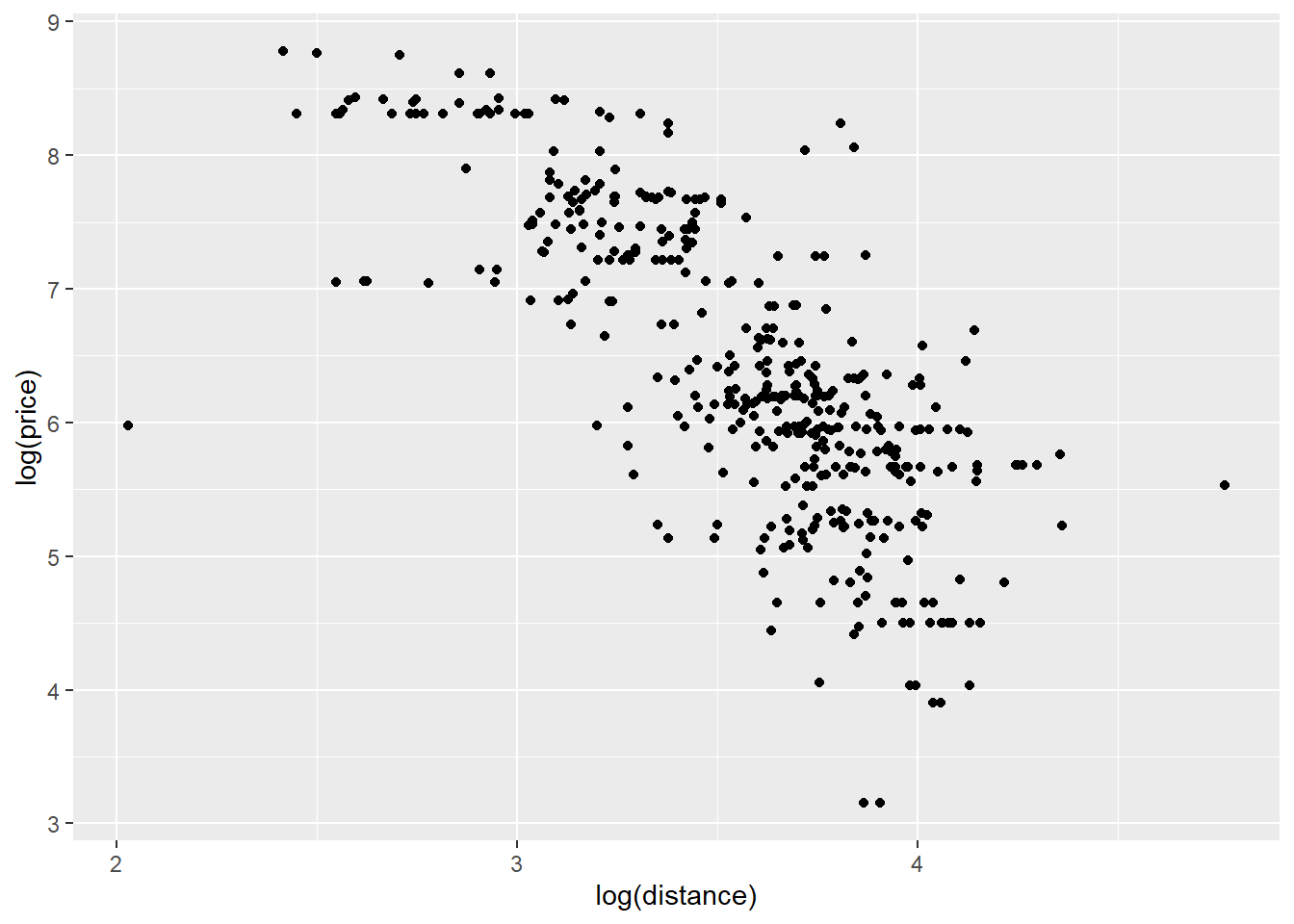

The scatterplot of price vs. distance does not look linear but more of curved. We will focus on predicting price based on the distance variable. We will look at a simple linear regression where we will try to predict price as a function of distance. First let us convert the price and distance variable to log scale and look at scatterplot of the same.

# select the distance and price variable and convert to log scale

data2 <- data |> subset(,c("distance", "price")) |> log()

# scatterplot of price vs. distance

ggplot(data2,aes(price,distance))+geom_point()+

labs(y = "log(price)", x="log(distance)")

Once we convert the variables to log scale, the scatterplot looks more linear compared to the scatterplot where the variables are not on log scale. We will first look at simple linear regression

# split the data into training and testing data

seed <- 23

set.seed(seed)

ind <- sample(floor(0.75*nrow(data)),

replace = FALSE)

# Training dataset

data_train <- data2[ind,]

# Testing dataset

data_test <- data2[-ind,]

# Simple linear regression using raw data

model <- lm(price ~ distance, data = data_train)

summary(model)

Call:

lm(formula = price ~ distance, data = data_train)

Residuals:

Min 1Q Median 3Q Max

-1.65672 -0.11925 0.00352 0.14145 0.95893

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 5.33983 0.08801 60.67 <2e-16 ***

distance -0.27701 0.01353 -20.47 <2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2608 on 308 degrees of freedom

Multiple R-squared: 0.5763, Adjusted R-squared: 0.5749

F-statistic: 418.9 on 1 and 308 DF, p-value: < 2.2e-16# Prediction on the testing dataset

y_pred <- predict(model, data_test)

# Calculate residuals = observed - predicted

residuals <- (data_test$price - y_pred)

# Residual vs. predicted plot

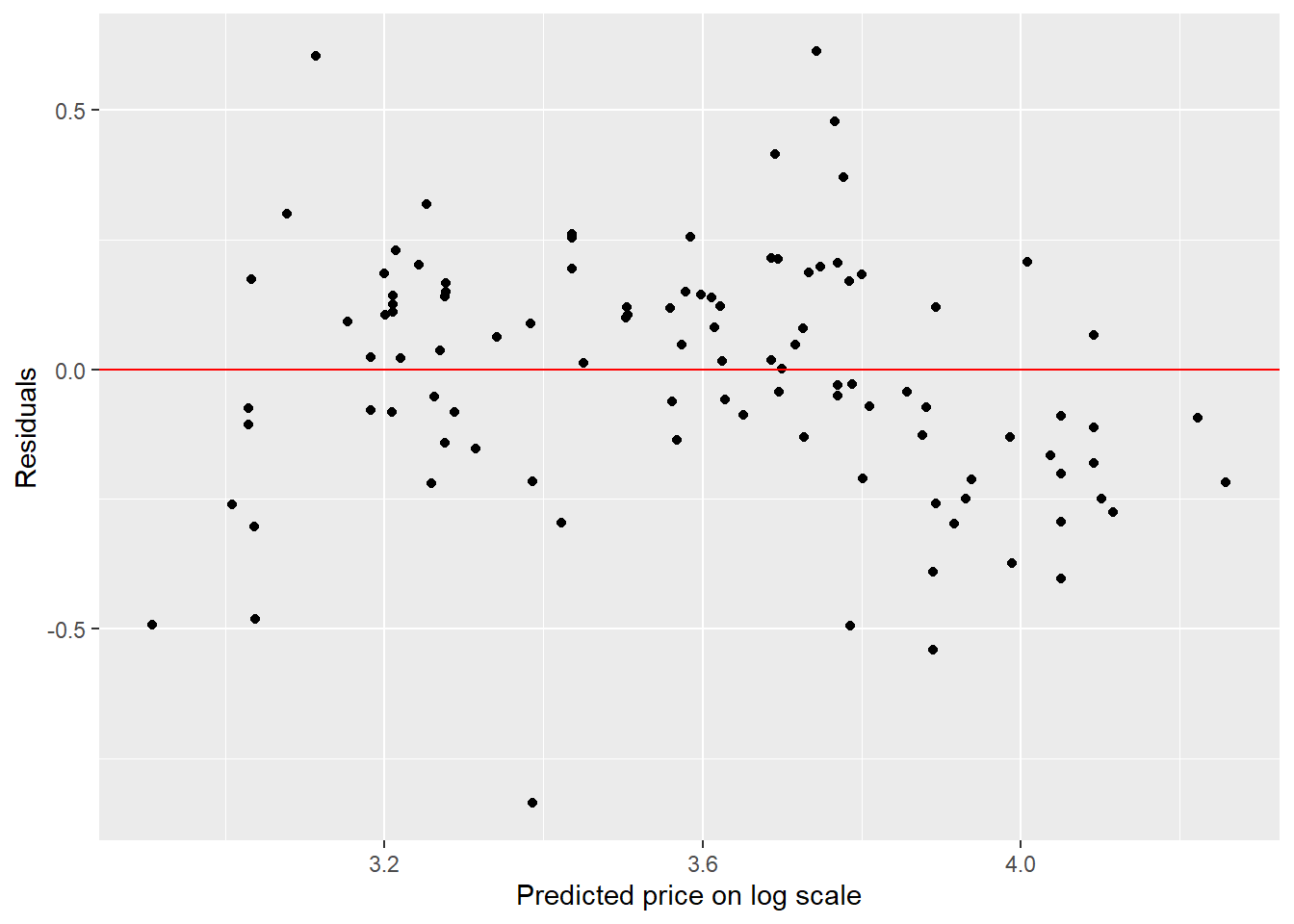

ggplot(NULL,aes(y_pred,residuals))+geom_point()+

labs(y = "Residuals", x="Predicted price on log scale")+

geom_hline(yintercept = 0, colour = "red")

The residual plot shows a slight curved pattern which indicates the linearity assumption of the model is not satisfied. Hence our model is not reliable. This is not surprising since the scatterplot indicates a slight curved fit rather than a linear fit.

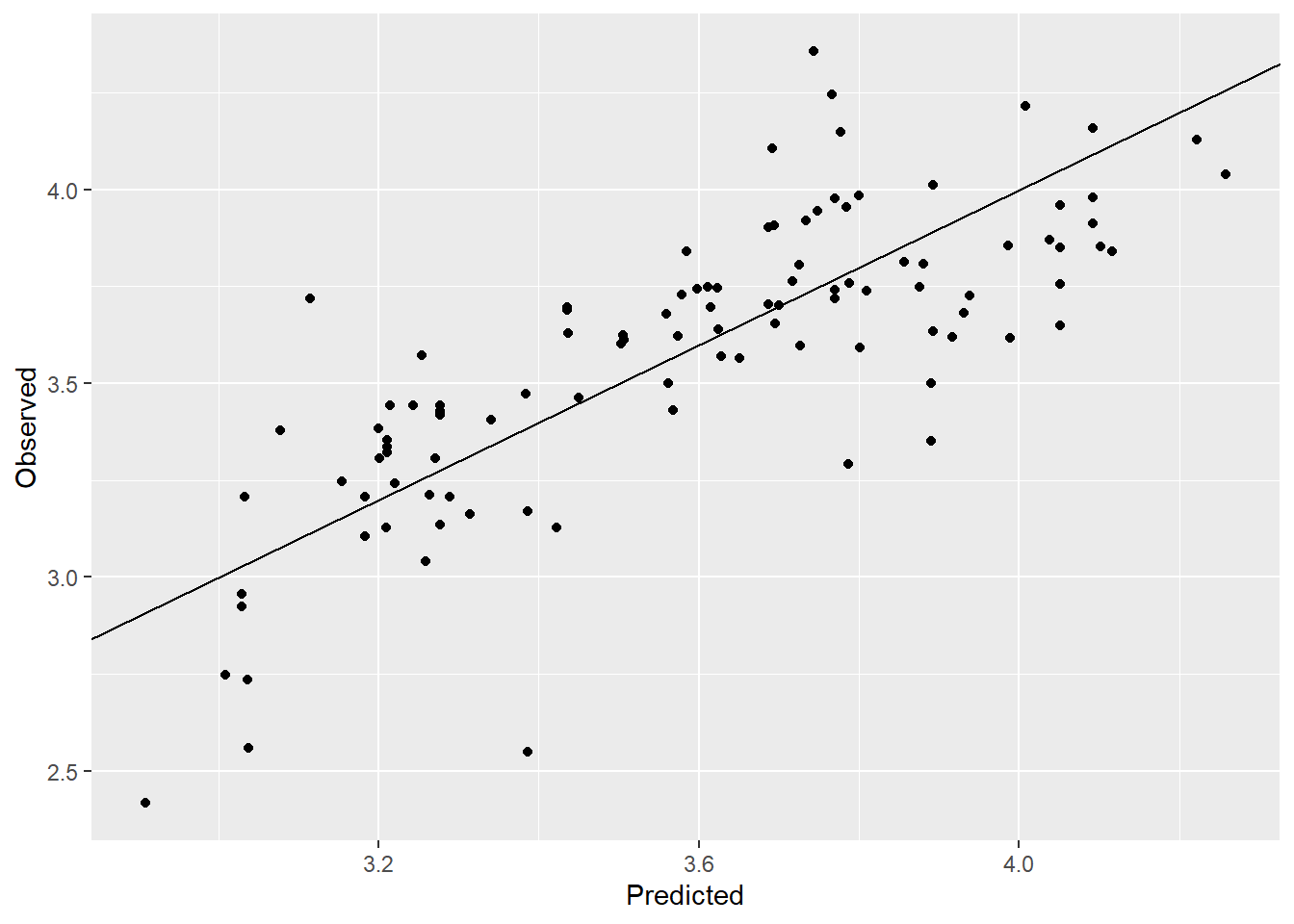

# Create a observed vs. predicted plot

ggplot(NULL,aes(y_pred,data_test$price))+geom_point()+

labs(y = "Observed", x="Predicted")+

# lims(x=c(0,80),y=c(0,80))+

geom_abline()

# Calculate RMSE

rmse <- (residuals)^2 |> mean() |> sqrt()

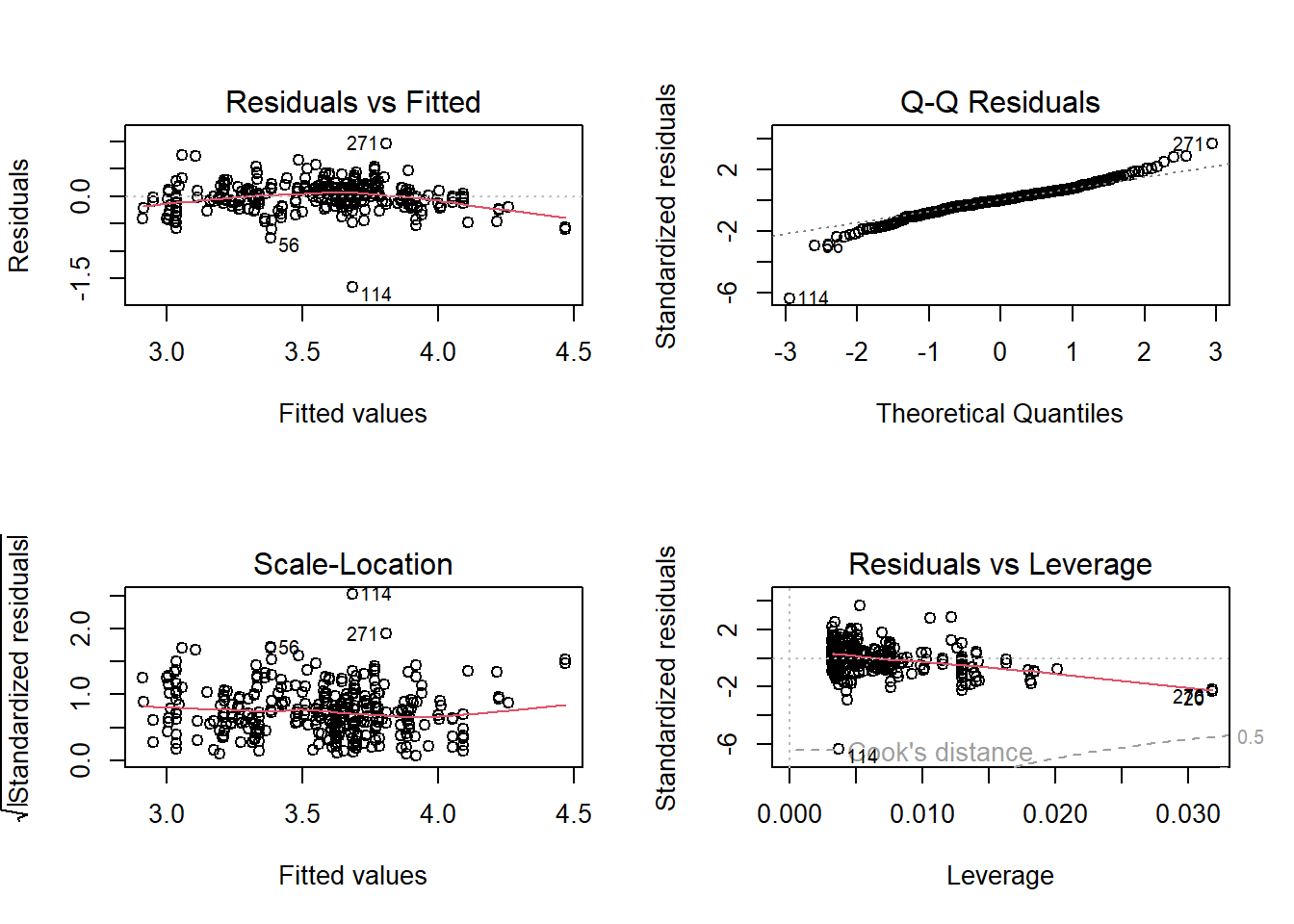

round(rmse,2)[1] 0.24# Check the assumptions of the regression model

par(mfrow = c(2, 2))

plot(model)

The model is has RMSE = 2.43 and the observed vs. predicted plot is just about decent. We will now look at a Gaussian process model which can handle non linear relationships very well.

# Read the GP STAN model

# Read the STAN file

file_stan <- "GP.stan"

# Compile stan model

model_stan <- cmdstan_model(stan_file = file_stan,

cpp_options = list(stan_threads = TRUE))

model_stan$check_syntax()x_train <- data_train[,-1]

y_train <- data_train[,1]

x_test <- data_test[,-1]

y_test <- data_test[,1]

x_train <- x_train |> as.matrix()

x_test <- x_test |> as.matrix()

standata <- list(K = ncol(x_train),

N1 = nrow(x_train),

X1 = x_train,

Y1 = y_train,

N2 = nrow(x_test),

X2 = x_test,

Y2 = y_test)

fit_optim <- model_stan$optimize(data = standata,

seed = seed,

threads = 10)Initial log joint probability = -565.855

Iter log prob ||dx|| ||grad|| alpha alpha0 # evals Notes

15 -46.7172 5.19148e-05 0.000881358 0.9501 0.9501 20

Optimization terminated normally:

Convergence detected: relative gradient magnitude is below tolerance

Finished in 0.4 seconds.fsum_optim <- as.data.frame(fit_optim$summary())

# The optimized parameter would be

par_ind <- 2:4

opt_pars <- fsum_optim[par_ind,]

opt_pars variable estimate

2 lambda 1.114400

3 sigma 2.776290

4 tau 0.662449# starting value of parameters

start_parameters <- rep(list(list(lambda = opt_pars[1,2],

sigma = opt_pars[2,2],

tau = opt_pars[3,2])),4)

# Run the MCMC with optimized values as the starting values

fit <- model_stan$sample(

data = standata,

init = start_parameters,

seed = seed,

iter_warmup = 1000,

iter_sampling = 1000,

chains = 4,

parallel_chains = 4,

refresh = 1000,

threads = 8,

save_warmup = FALSE)Running MCMC with 4 parallel chains, with 8 thread(s) per chain...

Chain 1 Iteration: 1 / 2000 [ 0%] (Warmup)

Chain 2 Iteration: 1 / 2000 [ 0%] (Warmup)

Chain 3 Iteration: 1 / 2000 [ 0%] (Warmup)

Chain 4 Iteration: 1 / 2000 [ 0%] (Warmup) Chain 4 Iteration: 1000 / 2000 [ 50%] (Warmup)

Chain 4 Iteration: 1001 / 2000 [ 50%] (Sampling)

Chain 2 Iteration: 1000 / 2000 [ 50%] (Warmup)

Chain 2 Iteration: 1001 / 2000 [ 50%] (Sampling)

Chain 1 Iteration: 1000 / 2000 [ 50%] (Warmup)

Chain 1 Iteration: 1001 / 2000 [ 50%] (Sampling)

Chain 3 Iteration: 1000 / 2000 [ 50%] (Warmup)

Chain 3 Iteration: 1001 / 2000 [ 50%] (Sampling)

Chain 2 Iteration: 2000 / 2000 [100%] (Sampling)

Chain 4 Iteration: 2000 / 2000 [100%] (Sampling)

Chain 2 finished in 330.8 seconds.

Chain 4 finished in 330.9 seconds.

Chain 1 Iteration: 2000 / 2000 [100%] (Sampling)

Chain 1 finished in 338.7 seconds.

Chain 3 Iteration: 2000 / 2000 [100%] (Sampling)

Chain 3 finished in 350.6 seconds.

All 4 chains finished successfully.

Mean chain execution time: 337.7 seconds.

Total execution time: 351.0 seconds.# Summary

# fit$summary()

# Save the summary

fsum <- as.data.frame(fit$summary())

# Plot posterior distribution of parameters

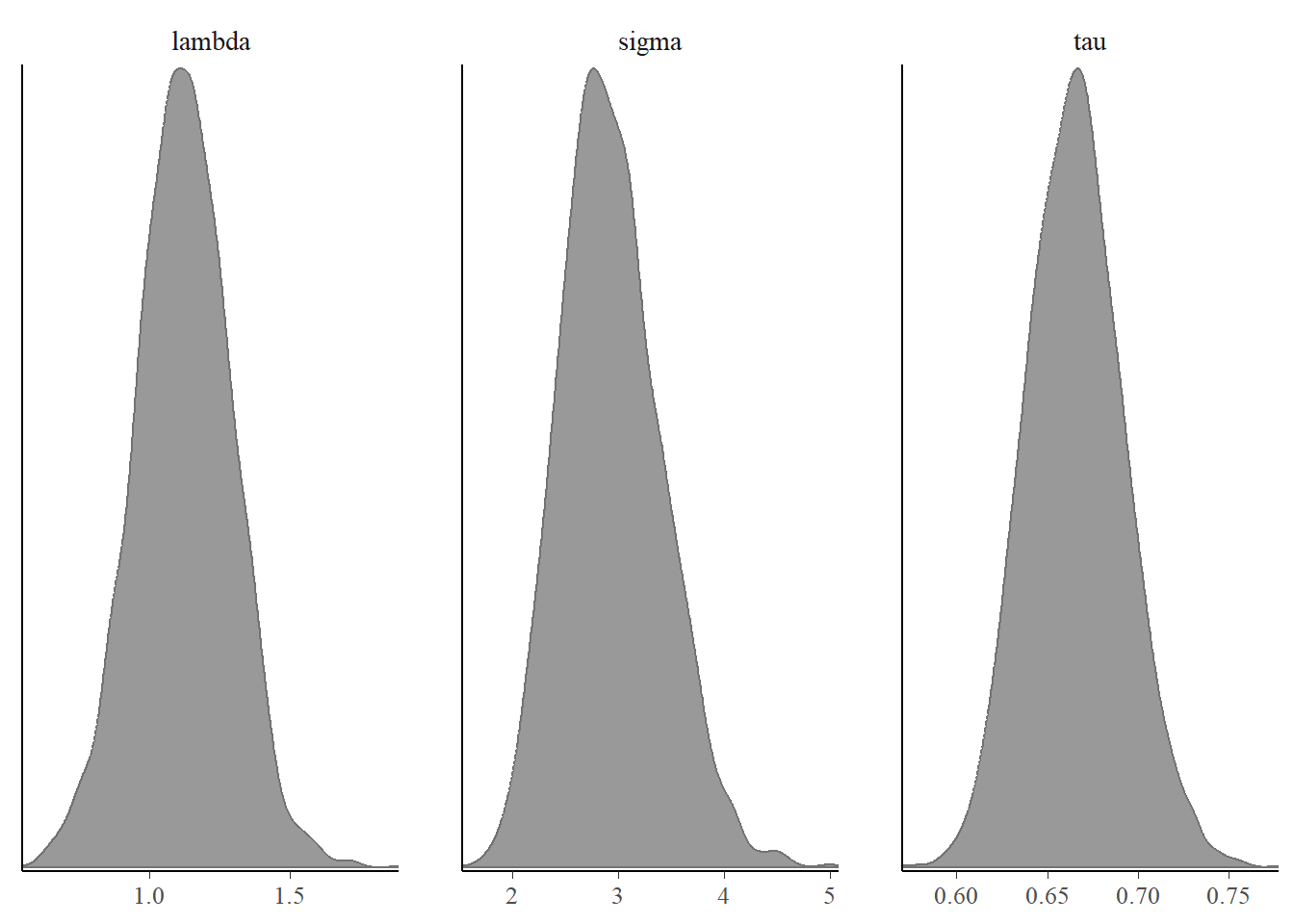

bayesplot::color_scheme_set("gray")

bayesplot::mcmc_dens(fit$draws(c("lambda","sigma","tau")))

The posterior distribution of parameters look good with unimodal distribution and the trace plots also show good mix so we can say the parameters have converged.

# index for predictive mean and variance

pred_mean_ind <- max(par_ind)+(1:length(y_test))

pred_var_ind <- max(pred_mean_ind)+(1:length(y_test))

# Prediction

y_observed <- y_test #observed

y_predicted <- fsum[pred_mean_ind,c(2)] #predicted mean

y_predicted_var <- fsum[pred_var_ind,c(2)] #predicted

lb <- y_predicted + qnorm(0.05,0,sqrt(y_predicted_var))

ub <- y_predicted + qnorm(0.95,0,sqrt(y_predicted_var))

# Predictions with bounds

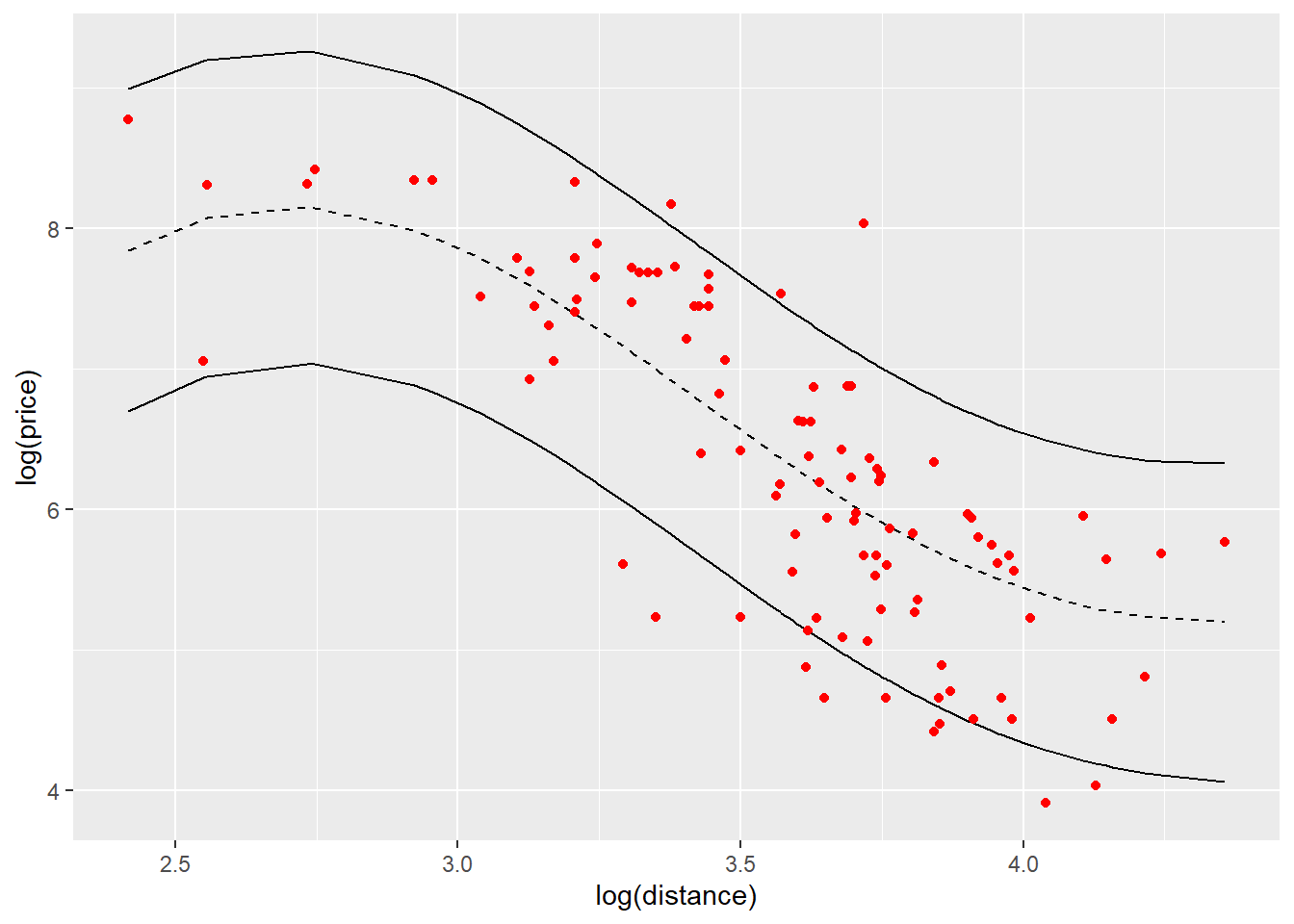

pred <- ggplot(NULL,aes(x_test,y_predicted))+geom_line(linetype = 2)+

geom_line(aes(x_test,lb))+

geom_line(aes(x_test,ub))+

geom_point(aes(x_test,y_observed),col="red")+

labs(y = "log(price)", x="log(distance)")

pred

The black dashed line is the predictive mean price on log scale for distance on log scale. The black solid lines give the 95% upper bound and lower bound for predictions. The points indicated in red color are the observations in testing data set and we can see most of them are in the prediction bounds.

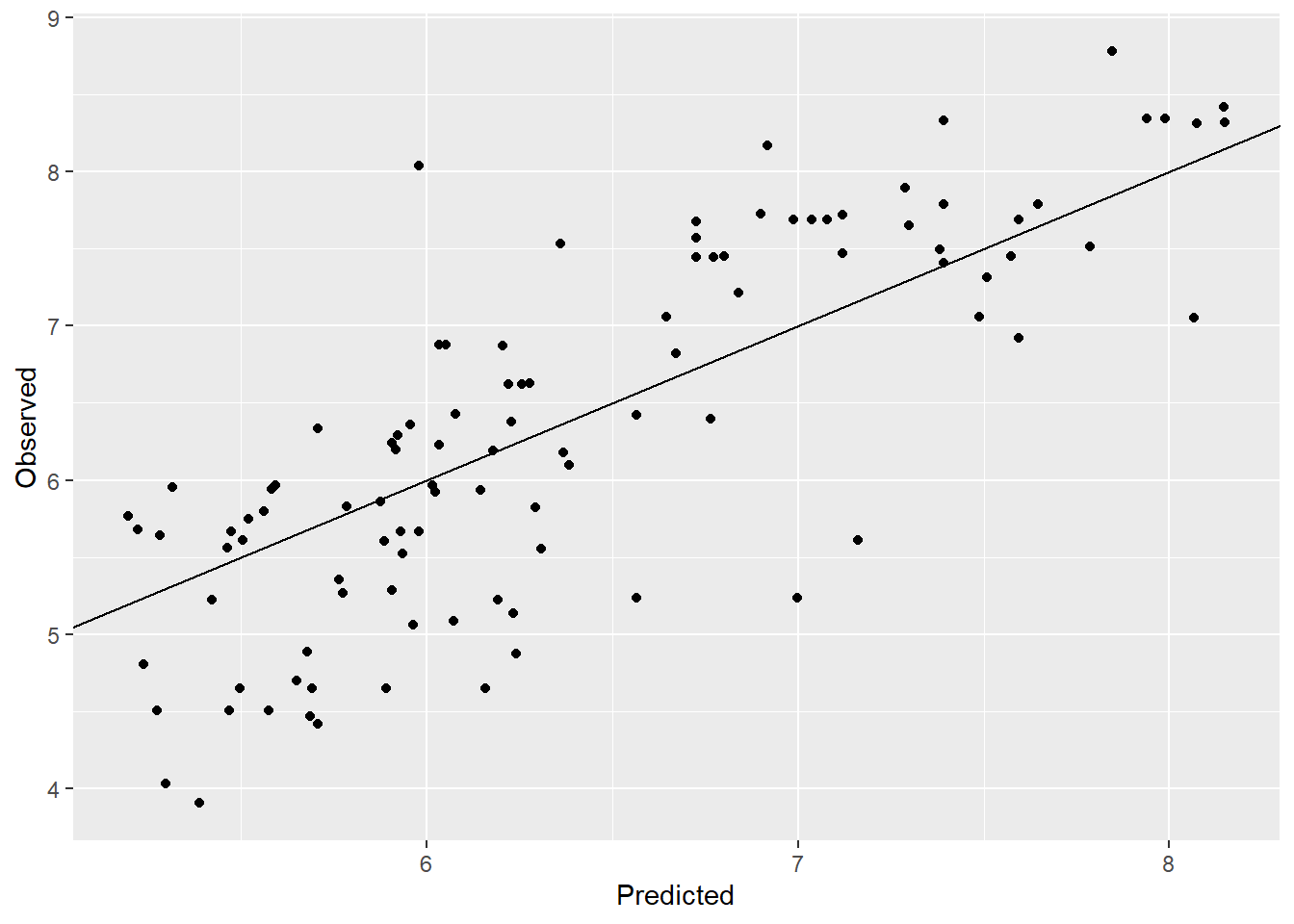

# Observed vs predicted

ovp_1d <- ggplot(NULL,aes(y_predicted,y_observed))+geom_point()+

labs(y = "Observed", x="Predicted")+

geom_abline()

ovp_1d

rmse = sqrt(mean((y_observed-y_predicted)^2)) |> round(2)

rmse[1] 0.73Observed vs. predicted plot also looks good with a few points away from the line. The RMSE improved from 2.43 to 0.22 which is a good improvement.